Navigate California's SB 261 with confidence — powered by KERAMIDA’s expertise and proven three-step compliance process.

CA SB 261 Compliance Solutions

California’s Climate-Related Financial Risk Act (SB 261) now requires large companies, both public and private, operating in California with over $500 million in annual revenue to publish detailed climate-related financial risk reports every two years. The first reports are due January 1, 2026, and must align with global standards such as the TCFD or IFRS S2 Sustainability Disclosure Standards. If your company cannot fully meet these standards, you must transparently explain any gaps and your plan to address them.

Expert Compliance Support

At KERAMIDA, we bring over three decades of environmental consulting experience and a proven track record of advising clients to align with the disclosures outlined in the Final Report of the Task Force on Climate-Related Financial Disclosures (TCFD) and the International Financial Reporting Standards (IFRS). Our team of specialists in climate risk and ESG is prepared to ensure your business achieves full compliance by 2026 and is strategically positioned for 2028 and beyond.

We provide businesses subject to SB 261 with a comprehensive range of services, including risk assessment, scenario analysis, data collection and reporting, disclosure preparation, and advisory services. Although not required by SB 261, assurance enhances the quality and confidence of the climate risk reporting.

Our SB 261 Compliance Services include:

Climate-Related Financial Risk Report Preparation (TCFD / IFRS S2)

Comprehensive Climate Scenario Analysis

Stakeholder Engagement and Disclosure Strategy

Gap Analysis and Remediation Planning

Our Proven SB 261 Compliance Process

To simplify compliance with SB 261 and meet the stringent requirements established by the California Air Resources Board (CARB), we have developed a clear three-step process based on our IFRS expertise and years of experience working with TCFD.

1. Gap Assessment (1–4 weeks)

We evaluate your current climate risk disclosure practices, help you select the most suitable framework (e.g., TCFD, IFRS S2), and conduct a gap assessment to benchmark against SB 261 requirements.

2. Strategic Roadmap Development (4–6 weeks)

We develop a clear, actionable plan with your team to close gaps, enhance climate risk readiness, and align your operations with SB 261’s expectations.

3. Report Preparation & Submission Support (1–2 weeks)

KERAMIDA prepares your climate-related financial risk report, ensuring full alignment with CARB. We deliver a fully compliant, submission-ready report, with guidance for submitting it by the January 1, 2026, deadline.

4. Post-Submission Implementation & Continuous Improvement (Optional and not required by 1/1/26)

Post-submission, we help implement the roadmap developed in Step 2, including actions to close remaining gaps, tracking progress, and future-proofing your disclosures as regulations continue to evolve. Additional services include: Climate-Related Risk and Opportunities Identification and Climate Scenario Analysis.

Featured Project Experience:

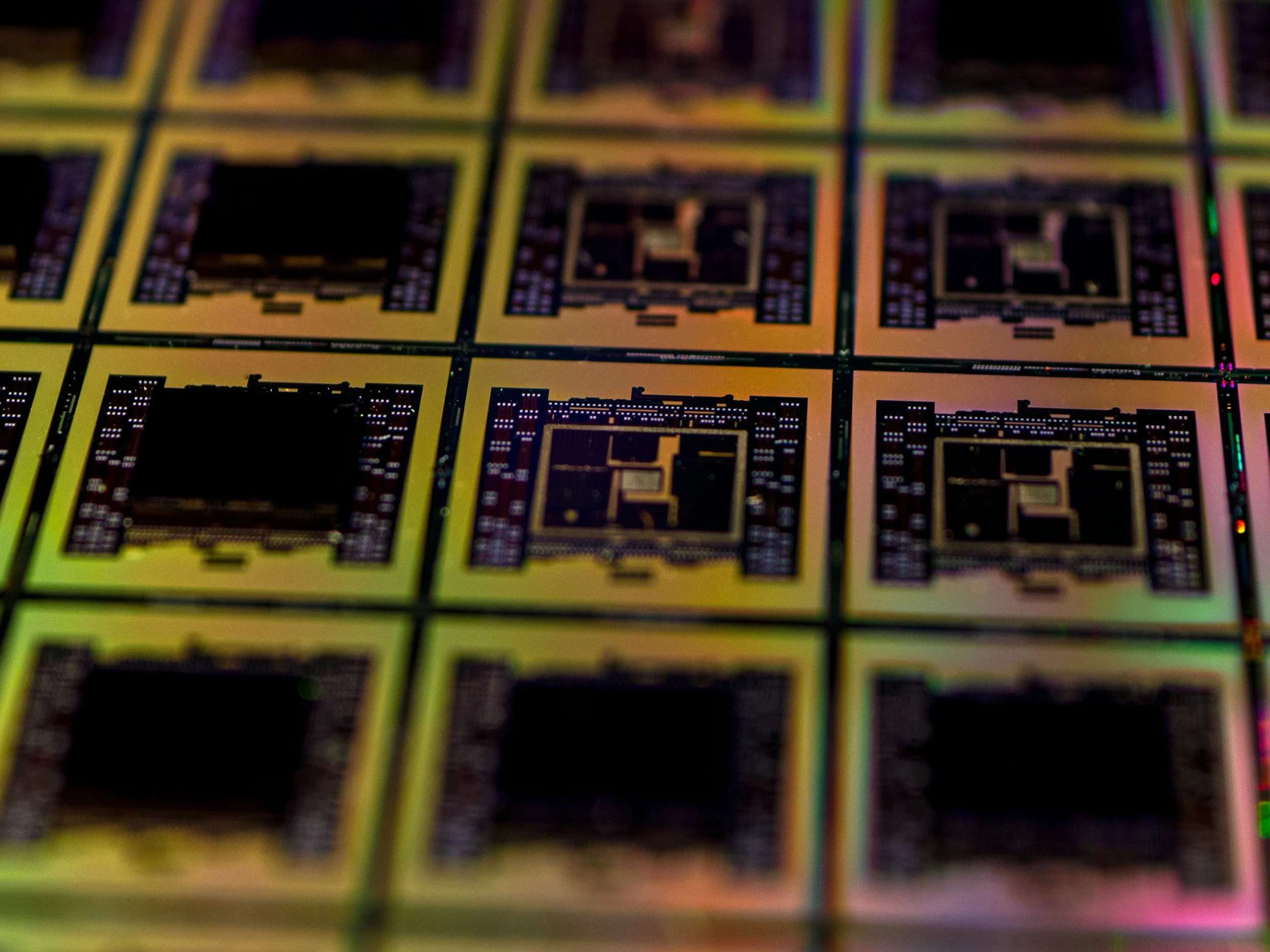

KERAMIDA is conducting a quantitative Climate Scenario Analysis for this Tech Client to support compliance with CA SB 261. The Client is an industry-leading technology company that designs and develops high-performance semiconductor and silicon IP products that advance data center connectivity. KERAMIDA is investigating the impacts of physical climate risks on the Client's main locations.

This Client is an international financial services firm providing Private Wealth Management, Trust, Asset Management, Investment Banking, Capital Markets and Private Equity services. KERAMIDA is supporting the Client with its inaugural IFRS S2 disclosure in preparation for compliance with CA SB 261.

KERAMIDA is supporting this American multinational law firm with its inaugural TCFD Climate-related Financial Risk disclosure in preparation for compliance with CA SB 261. Our tasks include: Regulatory review and analysis, stakeholder workshops to understand and build capacity around climate-related financial risk disclosures, evaluation of the Client’s current status and progress towards “comply or explain” disclosures, and more.

Why Partner with KERAMIDA?

-

We don’t just help you check the compliance box; we deliver robust, scenario-driven risk assessments that protect your business and satisfy investors and regulators.

-

Our team understands the nuances of California’s evolving climate regulations, ensuring your reports meet local and global expectations.

-

From initial risk identification and scenario analysis to final report preparation and stakeholder communication, we guide you every step of the way.

-

We adapt our approach to your sector, helping you address unique risks and opportunities specific to your business.

Recommended Insights:

Related Services:

From readiness assessments to full third-party assurance, we tailor our support to your maturity and goals. We use a risk-based, sector-specific methodology backed by deep technical expertise in ESG, sustainability reporting, and regulatory compliance. Our multidisciplinary team includes Accredited Lead GHG Verifiers, ESG specialists, Chartered Professional Accountants, Engineers, and Environmental Scientists. KERAMIDA is a CDP Global Gold Verification Provider and an AA1000 Licensed Assurance Provider.

Trusted for Verification and Assurance by Fortune 500 companies from a major U.S. stock market index and a global media & entertainment conglomerate to one of the largest U.S. steel producers and a world leader in marine recreation. KERAMIDA provides independent verification and assurance of GHG emissions for organizations across any industry in accordance with a variety of accepted standards, including ISO 14064-3 standards. KERAMIDA is a CDP Global Gold Verification Provider and an AA1000 Licensed Assurance Provider.